Cryptocurrency market forecast for long-term investors: A Comprehensive Guide

Exploring the world of Cryptocurrency market forecast for long-term investors, this introduction offers a detailed look at the factors, trends, risks, and strategies involved in making informed investment decisions in the crypto space. With a blend of casual formal language style, readers are invited to embark on a journey of understanding and discovery.

The subsequent paragraph will delve into the specifics of the topic, providing valuable insights and information for readers interested in long-term cryptocurrency investments.

Factors influencing the cryptocurrency market forecast

Cryptocurrency investments are influenced by various factors that can have a significant impact on their long-term outlook. These factors include economic indicators, regulatory changes, and technological advancements that shape the overall forecast for the cryptocurrency market.

Economic Indicators

- Economic stability of countries: The economic conditions of countries where cryptocurrencies are widely adopted can affect investor confidence and adoption rates.

- Inflation rates: High inflation can drive investors towards cryptocurrencies as a hedge against traditional fiat currencies.

- Global trade and geopolitical factors: Events such as trade wars or political instability can lead to increased interest in cryptocurrencies as a safe haven asset.

Regulatory Changes

- Government regulations: Changes in regulations, such as bans or restrictions on cryptocurrency trading, can impact market sentiment and adoption.

- Legal clarity: Clear regulatory frameworks can provide stability and encourage institutional investors to enter the market.

- Compliance requirements: Increased regulatory compliance can lead to more transparency and legitimacy in the cryptocurrency market.

Technological Advancements

- Blockchain developments: Advancements in blockchain technology can enhance scalability, security, and efficiency, making cryptocurrencies more attractive for long-term investments.

- Smart contracts: The implementation of smart contracts can streamline processes and create new opportunities for decentralized finance (DeFi) applications.

- Interoperability solutions: Projects focusing on interoperability between different blockchain networks can improve overall usability and adoption of cryptocurrencies.

Historical trends in the cryptocurrency market

Cryptocurrencies have experienced significant volatility since their inception, with several boom-and-bust cycles shaping the market. Understanding these historical trends is crucial for long-term investors looking to navigate the market successfully.

Market Cycles in the Cryptocurrency Space

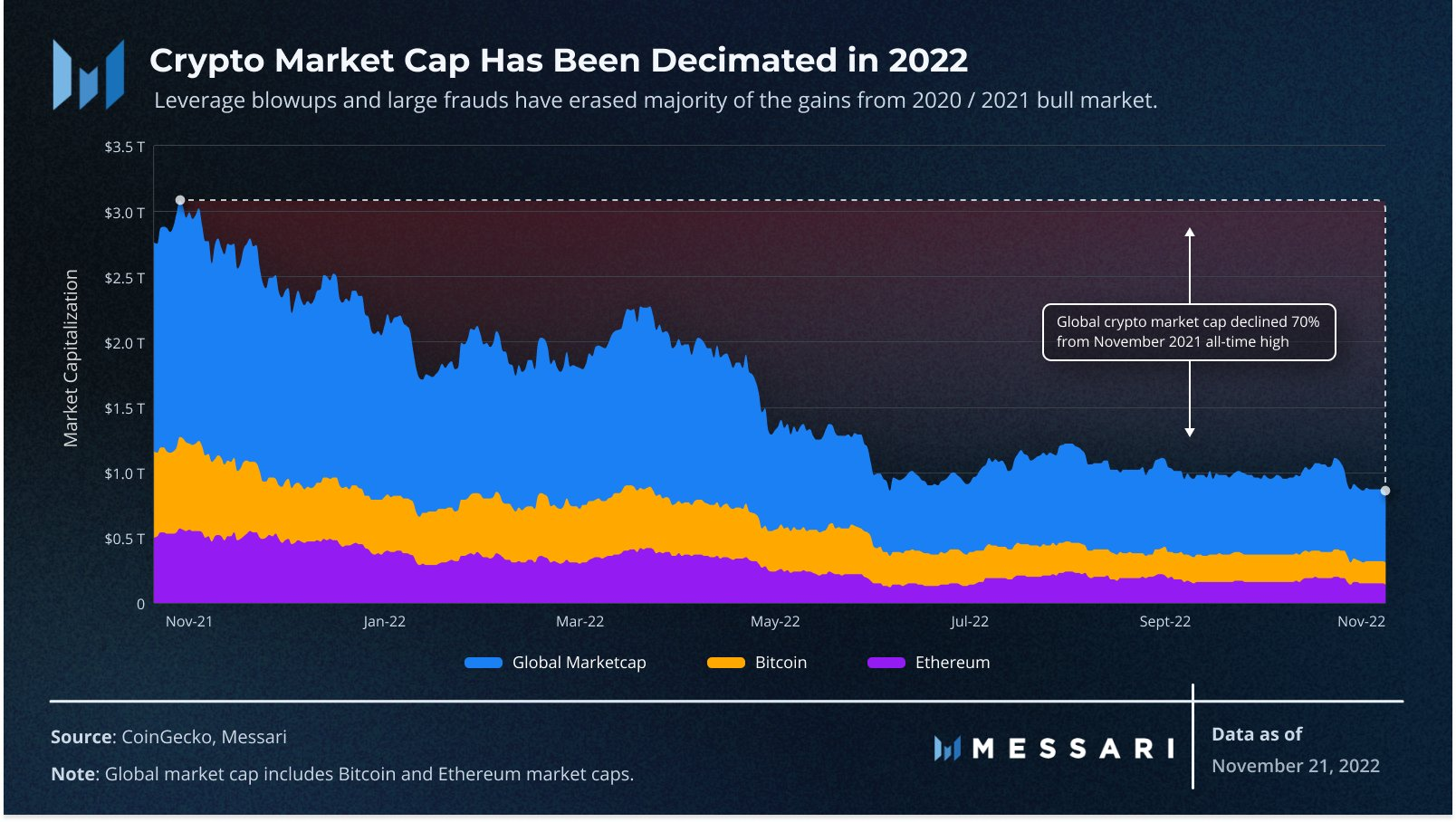

- Boom-and-Bust Cycles: The cryptocurrency market has witnessed multiple cycles of rapid price increases followed by sharp declines. These cycles are often driven by speculative trading, regulatory developments, and market sentiment.

- Bitcoin Dominance: Bitcoin, as the first and most well-known cryptocurrency, has historically influenced market trends. When Bitcoin experiences significant price movements, it tends to impact the entire market.

- Altcoin Seasons: Periods of market exuberance often see alternative cryptocurrencies (altcoins) outperforming Bitcoin. However, these altcoin seasons are typically followed by corrections as investors flock back to Bitcoin.

Performance of Different Cryptocurrencies

- Bitcoin vs. Altcoins: While Bitcoin remains the dominant cryptocurrency in terms of market capitalization and adoption, altcoins have carved out their own niches. Some altcoins have delivered impressive returns over the long term, while others have struggled to maintain value.

- Ethereum and Smart Contracts: Ethereum introduced the concept of smart contracts, allowing for programmable, decentralized applications. This innovation has positioned Ethereum as a leading platform for decentralized finance (DeFi) and non-fungible tokens (NFTs).

- Ripple and Cross-Border Payments: Ripple (XRP) aims to revolutionize cross-border payments through its blockchain-based solutions. However, regulatory challenges have impacted Ripple's performance in the market.

Impact of Major Events on the Cryptocurrency Market

- Regulatory Developments: Regulatory announcements from governments and financial institutions can have a significant impact on the cryptocurrency market. Clarity on regulations often leads to increased investor confidence and market stability.

- Market Adoption: Partnerships with traditional financial institutions, technological advancements, and growing mainstream acceptance have all contributed to the long-term growth of the cryptocurrency market.

- Halving Events: Bitcoin's supply is halved approximately every four years through a process known as "halving." This event has historically been associated with bullish price movements as supply decreases and demand remains constant or increases.

Risk factors to consider for long-term cryptocurrency investments

Cryptocurrency investments come with a set of risks that long-term investors need to consider. These risks can significantly impact the value of your investment over time. It's essential to understand and evaluate these risk factors before committing to holding cryptocurrencies for an extended period.

Market Volatility and Decision-Making

Market volatility is a significant risk factor in the cryptocurrency space. Prices of digital assets can fluctuate dramatically within a short period, leading to potential gains or losses for investors. This volatility can make it challenging for long-term investors to make informed decisions about when to buy or sell their holdings.

It's crucial to have a clear strategy in place to navigate through these market fluctuations effectively.

Security Concerns and Risk Mitigation

Security is another critical risk factor when it comes to long-term cryptocurrency investments. The decentralized nature of cryptocurrencies makes them vulnerable to hacking and theft. Investors need to take proactive measures to secure their holdings, such as using hardware wallets, two-factor authentication, and choosing reputable exchanges for trading.

Implementing robust security practices can help mitigate the risk of losing your investment due to cyber threats.

Long-term investment strategies in the cryptocurrency market

Cryptocurrencies have become an increasingly popular investment option for long-term investors looking to diversify their portfolios and potentially earn significant returns. When it comes to long-term investment strategies in the cryptocurrency market, there are several key approaches that investors can consider to build a robust and diversified portfolio.

Building a Diversified Cryptocurrency Portfolio

- One approach for long-term investors is to diversify their cryptocurrency holdings across different coins and tokens. By spreading investments across multiple assets, investors can reduce the risk of being overly exposed to any single cryptocurrency.

- Another strategy is to invest in a mix of large-cap, mid-cap, and small-cap cryptocurrencies. Large-cap coins like Bitcoin and Ethereum are considered less volatile but may offer lower growth potential, while mid-cap and small-cap coins can be more volatile but offer higher growth opportunities.

- Additionally, investors can consider investing in different types of cryptocurrencies, such as utility tokens, security tokens, and stablecoins, to further diversify their portfolio and mitigate risk.

Importance of Thorough Research in Long-term Cryptocurrency Investments

- Before making long-term investment decisions in the crypto space, it is crucial for investors to conduct thorough research on the projects, teams, use cases, and market potential of the cryptocurrencies they are considering investing in.

- By understanding the fundamentals of each cryptocurrency and staying informed about market trends and developments, investors can make more informed decisions and reduce the risk of investing in projects with limited long-term viability.

Setting Realistic Long-term Financial Goals in Cryptocurrency Investments

- When investing in cryptocurrencies for the long term, it is essential for investors to set realistic financial goals based on their risk tolerance, investment horizon, and overall financial objectives.

- Investors should establish clear investment goals, such as capital preservation, wealth accumulation, or income generation, and develop a strategic investment plan to achieve these goals over the long term.

- Setting realistic expectations and regularly reviewing and adjusting investment strategies based on market conditions can help long-term investors stay on track and navigate the volatility of the cryptocurrency market.

Final Summary

In conclusion, the discussion on Cryptocurrency market forecast for long-term investors highlights the importance of staying informed, conducting thorough research, and adopting sound investment strategies to navigate the complex yet promising world of cryptocurrencies. Through a blend of analysis and foresight, investors can position themselves for success in the evolving landscape of digital assets.

FAQ Section

What are some key economic indicators that impact long-term cryptocurrency investments?

Key economic indicators include GDP growth, inflation rates, and interest rates, which can influence the overall market sentiment and demand for cryptocurrencies.

How can regulatory changes affect the future outlook of the cryptocurrency market?

Regulatory changes can impact investor confidence, market liquidity, and legal compliance requirements, thereby influencing the adoption and valuation of cryptocurrencies in the long run.

What are some risk mitigation strategies for long-term cryptocurrency holdings?

Risk mitigation strategies include diversifying your portfolio, staying updated on market trends, using secure wallets, and setting stop-loss orders to limit potential losses.